Short term loans in Lincolnshire

from Able Loans

New customers can borrow up to £300.

Existing customers can apply through the Customer Portal

or by contacting their Agent.

Representative 596.90% APR

Representative Example: Total Amount of Credit - £200 |

Duration of agreement - 21 Weeks |

Interest Rate - 47% fixed |

21 weekly repayments of £14 |

Total Amount payable - £294

Applying won't affect your credit score.

Not all applications will be approved for a loan. An offer of credit is subject to status and affordability checks.

| Loan Amount: | |

| Weeks: | |

| Weekly Rate: | |

| Finance Charge: | |

| Total Amount Payable: | |

| Interest Rate: | |

| APR Representative: |

Why Choose Us?

Trusted

A local company run by people who care—because to us, you're not just a number, you're part of our community.

No Late Fees

Because we believe in fair and transparent lending, helping you stay in control of your finances without unnecessary penalties.

Authorised and Regulated

Authorised and regulated by the FCA, committed to fair treatment and positive customer outcomes.

Fast

Quick, easy, and hassle-free same day loans to fit your needs.

Convenient

Cash delivered to your door or sent straight to your bank, with a friendly agent on hand to help every step of the way.

What Do Our Customers Say?

David. - Lincolnshire

"Able Loans are a brilliant company with no hassle. Jen came round did the application and popped back the next day to issue the loan,easy to do from start to finish,I would recommend this company to any one looking for a loan"

Alexandra. - Lincolnshire

"Getting a loan was fast,efficient and professional. Tracy came out and explained about the loan and answered any queries we had. I was quite surprised at the low repayments and having the option to spread our loan over a set time.Great service”"

Margaret. - Lincolnshire

"Brilliant company! The whole process was super easy. Robert came round, helped with the application, and the cash was delivered the next day. Highly recommended for anyone looking for a reliable loan service!"

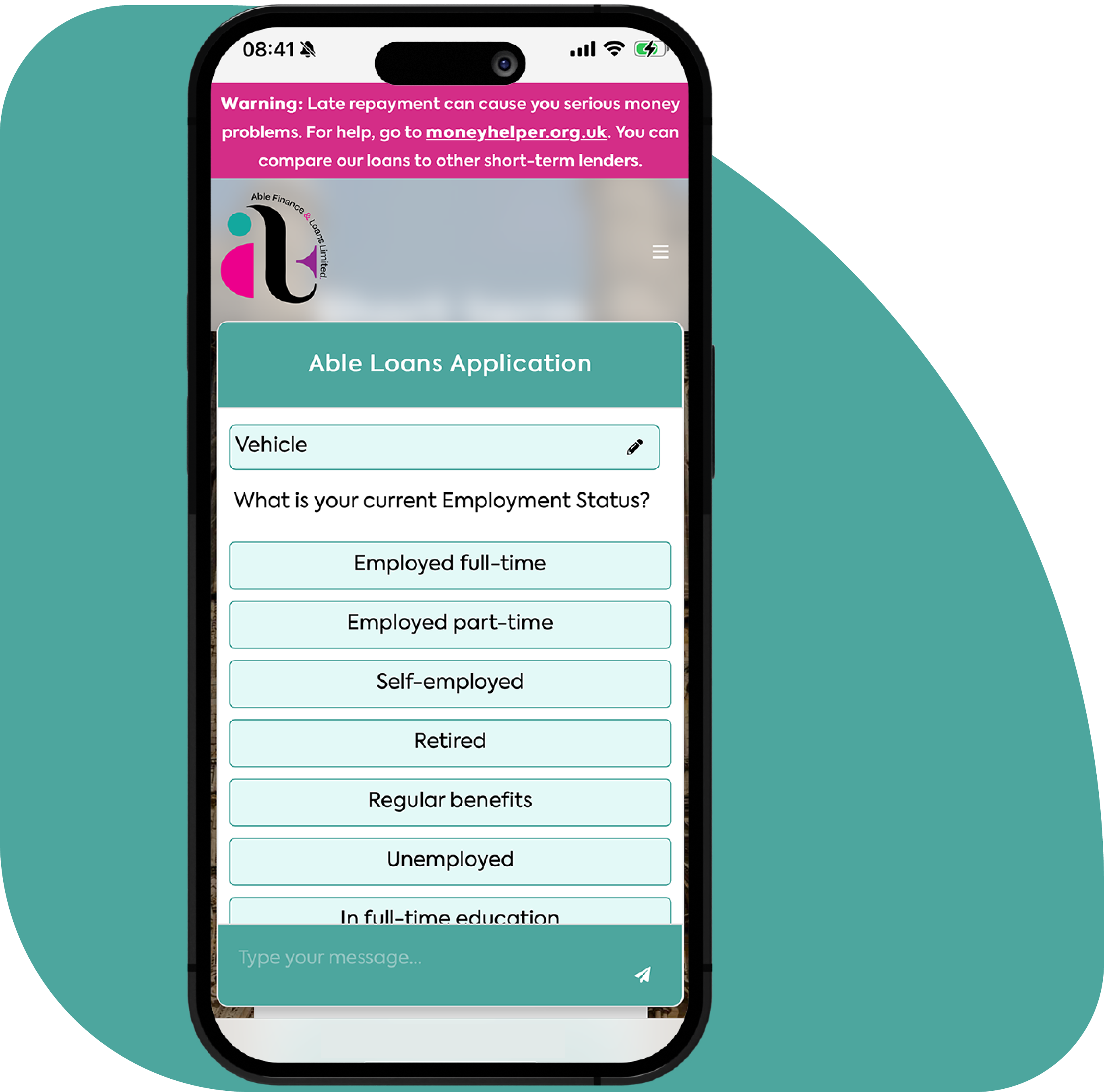

How Able Loans Works?

Applying for a loan with Able Finance & Loans is easy. You can fill in your details online via our application form by clicking "Apply Here"

If your application has been approved in principle, your local agent will be in touch to complete your affordability assessment and capture your identification/address details.

As a doorstep loan company, we can bring the loan directly to you in cash or pay it into your chosen bank account. We will work our payment terms with you, choosing a suitable repayment amount and payment date. Loans can be repaid via card or bank payments, or one of our home collected loan agents can visit you.

What We Offer

Short term loans

New customers can borrow from £100 to £300. Existing customers can borrow from £100 to £1000. However, it’s important to borrow only what you need and can comfortably repay within the designated repayment period.

Bad credit loans

We think people are more than their credit score, which is why we consider people with bad credit too. Before applying for a bad credit loan, do your research and compare the interest rates and terms.

Quick loans

A quick loan is a type of loan that offers fast approval and funding, often within hours of applying. In most cases, you can get the money the same day. You can apply for a quick loan and find out a decision the same day.

The alternative to payday loans

Able loans are a payday loan alternative. Our short term loans range from £100 to £300 for new customers and from £100 to £1000 for existing customers, and if approved, we’ll send the money to your bank or cash at your doorstep. Typically, you need to repay a payday loan on your next payday. Not with us, you can repay your loan in six months

Can I get a loan with poor credit?

At Able Loans, we understand that bad credit can happen to anyone. That’s why we consider people with less-than-perfect credit for a loan. Apply for a bad credit loan with us today and get a decision the same day.